The Importance of Payroll Services in Your Industry

The Importance of Payroll Services in Your Industry

Payroll services provide a great advantage to employers of any size. Whether you’re just starting out or managing a large business, investing in payroll services is an important part of managing your workforce efficiently. From streamlining payroll processes to providing accurate calculations and tracking employee data, payroll services are essential for any business wanting to stay organized and compliant. This blog will look at some of the key benefits of using a payroll service in your industry as well as frequently asked questions about getting started.

Source – QuickBooks

Streamline Payroll Processes

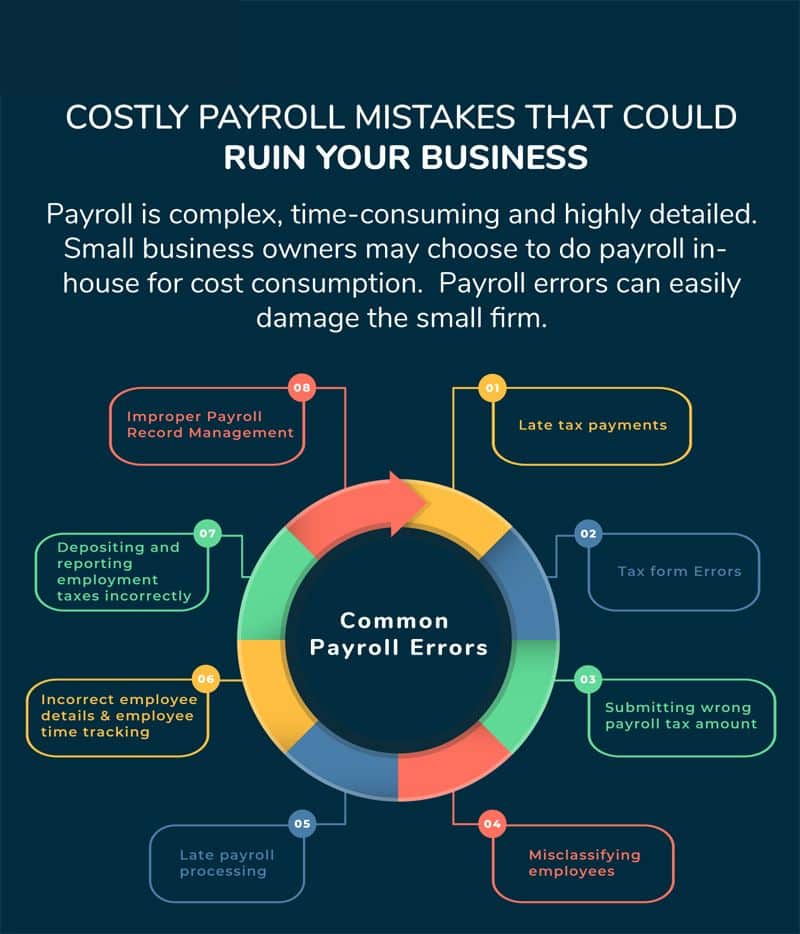

Payroll processes can be complicated and time-consuming. For many businesses, it’s a task that takes up valuable resources and affects their ability to focus on other important areas of their business. By investing in a payroll service, you’ll reduce the time and effort spent managing payroll while avoiding costly mistakes.

Automate Payroll Calculations

Payroll services can automate the calculations for taxes, deductions, and other payroll elements. This will help ensure that all calculations are accurate and in line with current regulations. It also allows you to receive updates on changes to laws or other rules related to your industry’s payroll processes.

Monitor Employee Data

Payroll services can also help you keep track of employee data, such as wages, hours worked, and vacation time. This is especially important when it comes to managing a large workforce or staying compliant with industry standards. With access to real-time employee data and automatic updates based on changes in regulations, you’ll be able to manage your employees more efficiently.

Streamline Payments

Another benefit of using payroll services is that they can streamline the payment process for both employers and employees. By automating payments, you’ll make sure that everyone gets paid on time, which will help with employee morale and reduce the risk of penalties for late payments.

Avoid Costly Mistakes

Payroll mistakes can be costly for businesses, leading to fines or penalties due to incorrect calculations or filing errors. By investing in a payroll service, you’ll have access to accurate data and advice on how to stay compliant with industry regulations. This will help you avoid costly mistakes and ensure that you stay on top of all payroll processes.

Reduce Filing Errors

Using a payroll service can reduce filing errors, as they are designed to automatically submit filings on your behalf. This ensures that all forms are completed accurately and in line with current regulations. It also saves you time and eliminates the risk of filing errors that can lead to costly penalties.

Access Professional Advice

Payroll services will also provide access to professional advice, allowing you to make sure that your payroll processes are up-to-date and compliant with industry standards. This can help reduce compliance risks and ensure that all payroll procedures are completed correctly.

Utilize Error Detection Software

Payroll services can also utilize error detection software to quickly identify and correct any mistakes before they become an issue. This helps save time and money in the long run, as errors can be avoided before they lead to costly penalties or fines.

FAQs:

1. How can payroll services help businesses?

Payroll services can reduce the time and effort spent managing payroll while providing access to accurate calculations, tracking employee data, and streamlining payment processes. They also provide professional advice on staying compliant with industry regulations and utilizing error detection software to quickly identify and correct any mistakes.

2. What are the benefits of using payroll services?

The benefits of using payroll services include reducing filing and payment errors, providing access to professional advice on industry regulations, and utilizing error detection software to quickly identify and correct any mistakes. This can help save time and money in the long run while ensuring that all payroll procedures are completed correctly.

3. How often should businesses update their payroll services?

Businesses should review their payroll services regularly to make sure that all regulations, policies, and processes remain up-to-date. This helps ensure compliance and accuracy while avoiding costly mistakes or penalties.

Conclusion:

Payroll services are essential for any business wanting to effectively manage its workforce and stay organized and compliant with industry regulations. From streamlining payroll processes to providing accurate calculations and tracking employee data, payroll services can help ensure that all payroll procedures are completed correctly while avoiding costly mistakes.