Audit Support Services

The IRS monitors the tax returns of every business each year and compares values to the returns paid previously. If there are discrepancies, the IRS will issue and audit. Smith & Smith & Ruiz CPA’s offers you the expert assistance of our expert CPAs to help you with audit support strategies and also represent you at the IRS during your audit.

There are many reasons why your business could get audited by the IRS. For the record, the IRS conducts a thorough investigation of all your business transactions in the past five years. These transactions are then tallied with the tax paid out against them in the same time. If there are signs of missed payments and illegitimate adjustments, the IRS will hold you responsible.

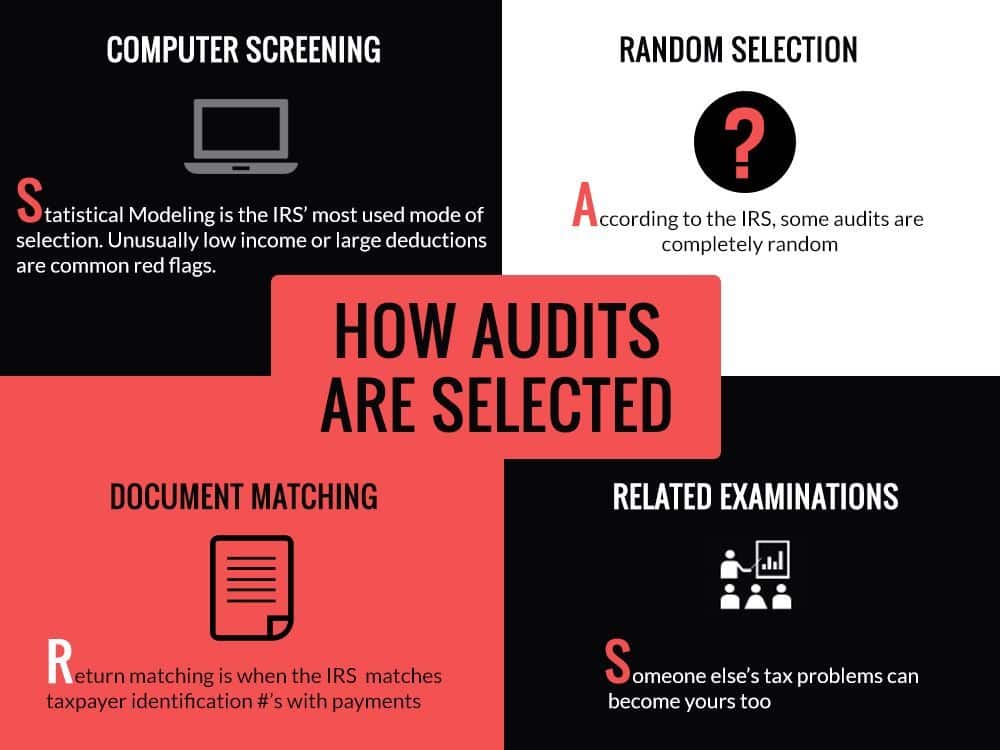

Typically, the IRS will conduct an audit for the following cases:

If the adjustments are over $10,000 in the last five years. This will also result in audits for consecutive years.

Your business has large or too many exempt sales.

Late filing is a very common reason. The IRS scrutinizes and eventually audits taxpayers that keep on filing late each year.

The expert CPAs at Smith & Smith are here to help you in case you get audited. Our audit support strategies are tailor-made to suit your business and we can help you:

Support and defend your audit returns through the highest level of appeals for as long as the audit lasts.

Schedule all your audit appointments and also attend them with you for your convenience.

Review all your tax returns in order to ensure there are no more problem areas

Thoroughly inspect all your documentation before the IRS reviews it in order to make sure there are no issues.

Help you in your correspondence with the IRS. This includes helping you understand the IRS notices and letters and how best to respond.

We are here to assist you with everything IRS has to throw at you. Not every case is the same and we make sure that you get detailed audit reports and support strategies from us that are custom-made for your benefit. We will also make sure that you stay well connected with our CPA network any time.

Remember, the auditor is mainly looking for underpayment in your transactions. Being audited does not mean the end of your business, but merely a snag in the grand scheme of things. The IRS laws differ from state to state as well.

If you are audited in the state of Texas, you can reach our offices in Dallas, Arlington, and Seagoville to get in touch with our experienced CPAs.