Tax Preparation Benefits at the IRS

Tax Preparation Benefits at the IRS

If you are about to pay your tax dues, you need prepare efficiently for it. In case you run into problems, you will need a CPA to handle your IRS representation in Dallas. With proper tax preparation, you can minimize complications and also make sure you stick to all the deadlines. Any lapse in the matter can lead you to paying unnecessary penalties.

Tax Preparation made easy

Each city comes with its own lifestyle and so the IRS assigns different rules for tax payouts. If you are in the Dallas Fort Worth area, you can have a CPA in Dallas to handle your tax preparation to get the best results.

Being the one who helped prepare your taxes, you can be represented by the same CPA at the IRS. This is an advantage for you because the accounting knowledge can help you pitch your plea to the IRS better.

Zero Penalties

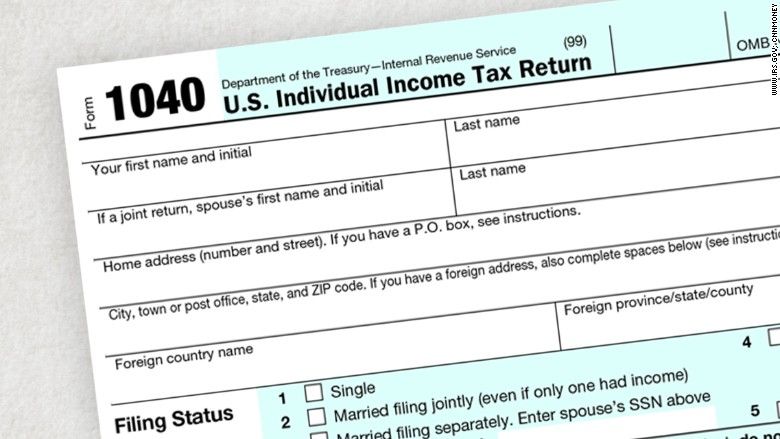

There are several assets that have different deadlines and you need to make sure that you maintain all of them when paying your taxes. This is because your tax payments are made all at once despite their varying deadlines. But even missing a single deadline can cause the IRS to impose penalties on your already existing tax dues. You can have a professional CPA to check your tax deadlines to conduct your tax preparations effectively.

Itemizing your assets is a good way to keep track of all your tax dues and the deadlines they have. You can have a CPA conduct your tax preparations to effectively itemize and sort through all your tax deadlines and calculate the exact total payout. This becomes necessary if you are conducting a business from your home. It is important to keep your personal and business finances separate so you can effectively maintain both deadlines also prepare for taxes effectively.

Secure your financial future

You stand to save more with proper tax preparation as you can avoid a lot of unnecessary expenses during your financial year. Since most tax laws are different in respective cities, you can get into trouble with the IRS if you are a tad negligent. If it so happens, you can have the CPA federal income tax preparation in Arlington who performed your tax preparation to be your representative at the IRS.

In order to secure your financial future, you need to make sure that you prepare for taxes each financial year and apply for deductions where your assets qualify. This way you stand to save more on your tax payouts and secure your finances for the coming year. Have a CPA perform tax deductions each year to apply for tax deductions effectively.