Secure Your Future With Estate Planning

Secure Your Future With Estate Planning

You never know what may happen in the near future, so it doesn’t hurt to be prepared. Estate planning can help secure the management or transfer of your property in your absence. We have an experienced team here at Smith n smith that can help you understand the process and create an effective strategy for estate planning.

Estate planning can be a problem if you have no idea how to organize your goals and make the preparations that will safeguard your property. You can get a CPA to define your estate goals and formulate all the necessary preliminaries to manage your estate.

Estate planning in a nutshell

Estate planning is all about making sure your current wills, trusts, healthcare and attorney privileges are in order. It is also important to ensure that your assets are kept that way with proper management. You can get a CPA to help organize and manage assets and also facilitate their transfer to respective heirs as per your preferences. Managing your estate on your behalf in case you are incapacitated is vital and is made easier when done by a professional.

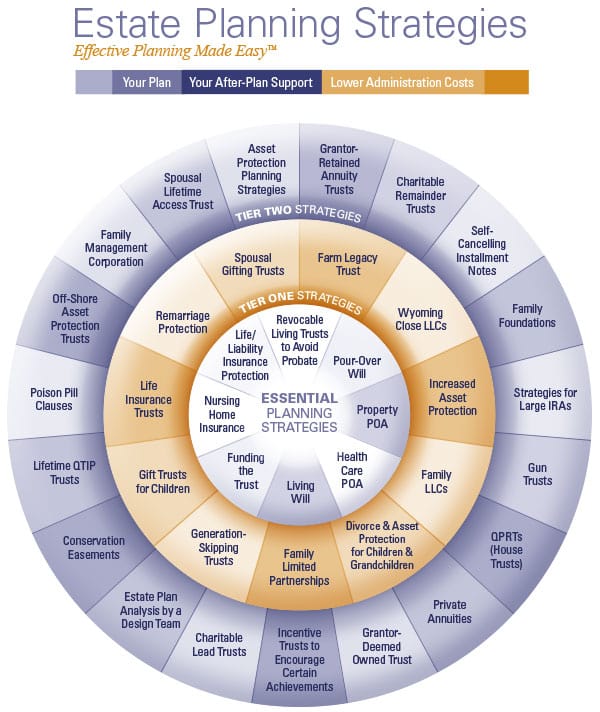

Estate planning strategies

You should adopt strategies that can help you with efficient estate planning which is vital for managing your property and assets in your absence.

- A will that specifies the transfer of your assets to an heir. In case this is absent, the state where you reside will determine heirs it for you.

- A living will stipulates life-saving medical procedures that you want or don’t want if you are physically or mentally incapacitated. It is usually carried out by an attorney with Medical power privileges.

- You can have a CPA set up an irrevocable life insurance trust. The proceeds of a life insurance policy held in your estate are subjected to estate tax. If the policy is owned by an irrevocable trust, the proceeds will not be included in your estate. Your CPA can advise you on the best strategies in this matter.

- Another strategy is where the donor transfers the property to the Charitable Remainder Trust to receive an immediate income-tax deduction and avoiding any capital gains taxes on donated appreciated property. The donor then receives an income stream that is generated by the trust assets for a predetermined time or for life. The charitable organization inherits the trust assets after that period has ended.

Need for estate planning

Once a person dies, the properties that were deemed his possession are taxed. The tax department considers that the properties are to be sold at fair market value on the day of death. The difference between the value of the property and the original price paid is called the capital gain and must be declared to the tax department. Consult a CPA to effectively conduct your estate planning.