S-corps are Not Viable for Dental Practices

S-corps are Not Viable for Dental Practices

Setting up your dental practice requires more than just your enthusiasm about treating patients. You need to organize the business side of the practice before you can get anywhere. It includes purchasing assets for your practice, paying your taxes, and managing funds to ensure that your practice generates a profit to keep itself afloat. Since the laws are not the same everywhere, a CPA in Dallas can advise you on the best way to set up your practice in Texas.

Setting up your practice

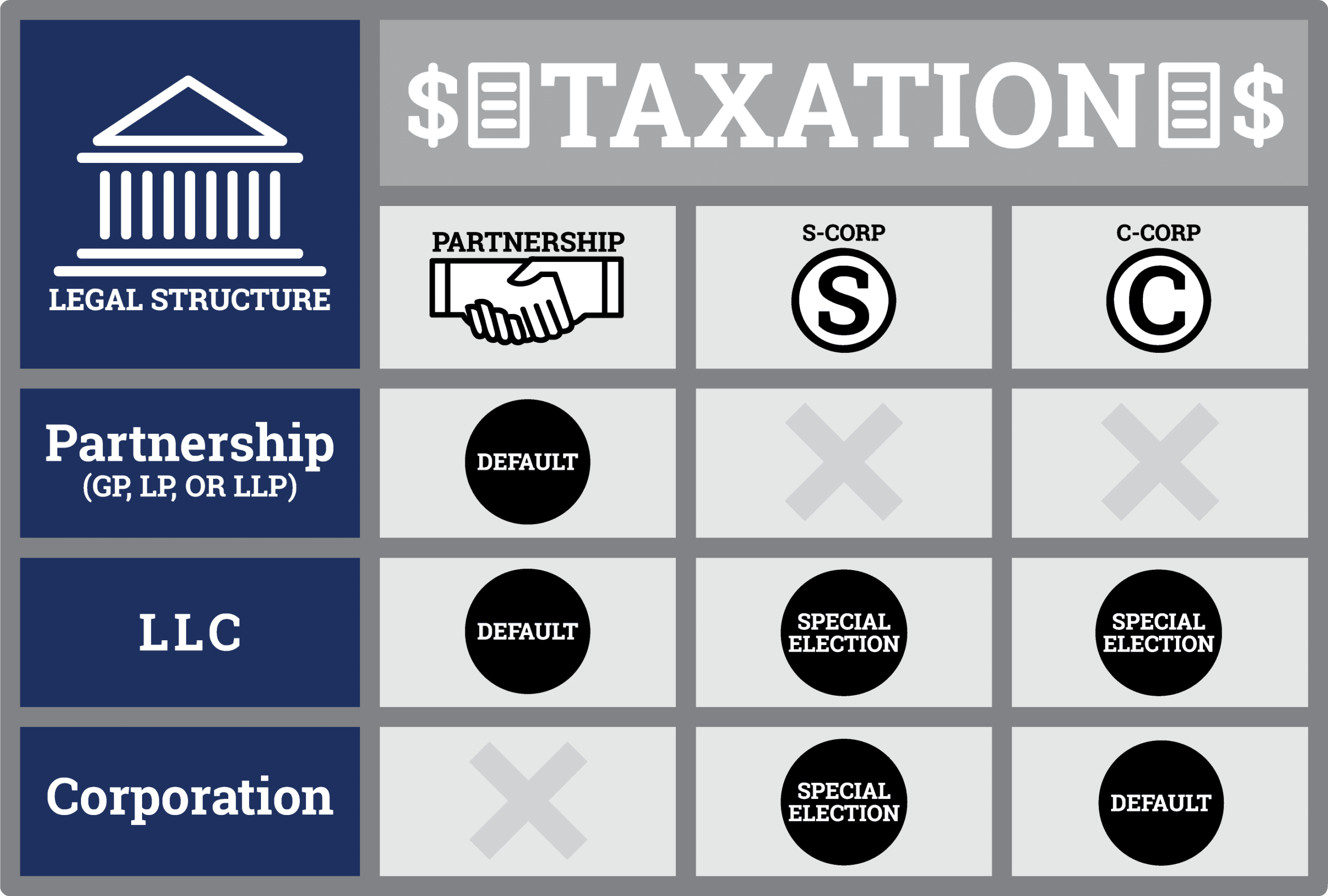

The first step is to decide if you want to set it up as an S-corp. or an LLC. Understanding the benefits of either case can help you come to a conclusion as to how you want your dental practice set up in order to flourish. Typically, an S-corp. is not advisable for a dental practice as it does not allow a large part of your assets to qualify for deductions. This is a factor more common with LLC and you can apply for relief on several assets belonging to your practice.

Having a CPA will help you manage the business aspects of your practice more effectively. You can focus on your patients leaving the CPA to analyze the business side of things so you can make critical decisions regarding your practice with the right information at hand. This information is even more crucial when preparing for taxes as it will help you generate a proper financial statement and projection for the financial year ahead.

Tax concerns

There are several aspects of your practice to consider when you are preparing to pay your taxes. You need to have a financial statement for the previous year to properly calculate the amount of tax you have to pay for your assets. The CPA performing your tax preparation can also generate a financial projection for the year ahead.

There is an income cap that will determine if being an S-corp. is ideal for your practice. If you do not meet that cap, you should switch to LLC in order to avoid problems with the IRS regarding tax payments. There are assets that you can’t apply for deductions on if you are below the income cap for your S-corp.

Savings and tax relief

There are several aspects of your business to consider before you can make your payments to the IRS. If you have been filing as an S-corp. you should keep in mind that your income cap depends the amount of tax you have to pay. Unless you cross that income cap each year, you won’t be able to apply for relief on assets that would have otherwise qualified. A practice depends on savings to grow, and without the crucial deductions to maximize your savings, you will always be limited by financial constraints.

To ensure that you get the maximum relief out of your day to day expenses, have your practice filed as an LLC to ensure that you are not limited by an income cap and can apply for assets that qualify for tax relief.