The Many Monetary Benefits of a Health Savings Account

The Many Monetary Benefits of a Health Savings Account

Saving money for a rainy day is a wise decision made by savvy people. You can never predict the future, but you can be proactive when it comes to certain financial matters.

Your health is priceless, but your body may be susceptible to illness and disease. Therefore, investing in your health is the best choice you can make today.

Having the financial means to pay for health care is the precious gift you can give yourself and your dependents.

Luckily, there is a savings account which combines saving money with health care, delivering them to you in one neat package.

The health savings account, also known as HSA, is like your very own savings account, but the money in this particular account is used to pay for medical expenses.

Health savings accounts were created in order to curb health care costs. If people were responsible for paying their own health expenses, then chances are, they will spend their hard earned money wisely.

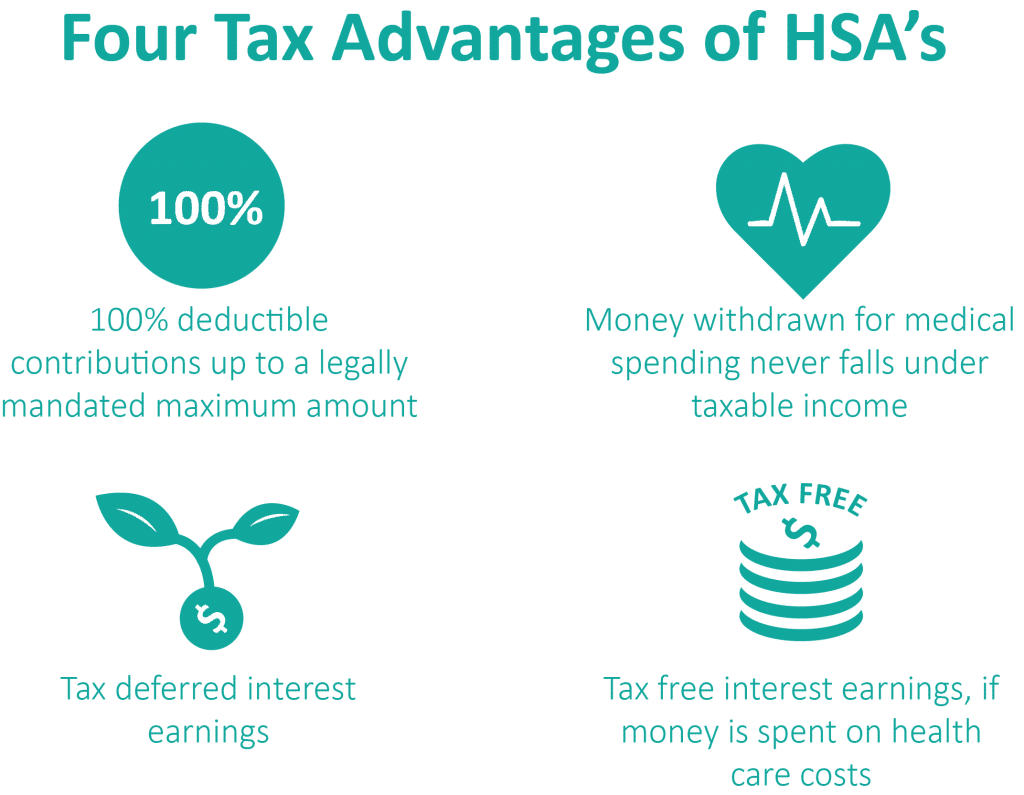

Advantages of HSAs:

- The money you put into your health savings account is tax-free.

- This money is your own. You can use it to pay for both current and future medical expenses you are entitled to along with your dependents.

- Any leftover money stays in your account (rolls over) to the next year.

- The best thing about an HSA is that it stays with you even if you switch jobs, change your medical coverage or marital status, and even if you move to an entirely different state.

- There is plenty of potential for growth since you can invest your contributions in a wide variety of investment options such as bonds, stocks and mutual funds.

- Health savings accounts are very convenient since most of them come with their own debit card. This makes it easier to pay for your medication and other expenses. All it takes is a press of a button for your card to do its magic.

Types of Medical Expenses Covered by the HSA

The following are medical expenses you, your spouse and dependents are qualified for, provided they meet the definition stated by the IRS regarding qualified medical expenses:

- Dental and vision care

- Prescription drugs and insulin

- Medicare premiums (For people age 65 or older)

- Most medical care and services such as: psychiatric care, laboratory fees, hearing aids among many others.

- Health plan deductibles and coinsurance

How to Set Up a Health Savings Account

You can open an account on your own or via your employer at any bank or financial institution. In order to be entitled for an HSA, you must be under the age of 65 and enrolled in a high-deductible insurance plan. This insurance plan must be your one and only insurance plan.

Knowing that you have enough money to pay for your medical expenses provides you with enough peace of mind to last a lifetime.

After all, health care costs are on the rise, skyrocketing like never before. Your future self will thank you for having the foresight to open such a smart, money savvy account.

For more tips on health and insurance, contact Smith & Smith CPA who provides the best accountant services in Arlington and Seagoville area. Schedule an appointment to discuss more.