Inflation Adjustments for Tax Provisions for the 2016-17 Year

Inflation Adjustments for Tax Provisions for the 2016-17 Year

The IRS had announced the inflation adjustments for the tax year 2016-17 back in the closing months of last year. Now that the time has come to prepare your taxes, let us review these adjustments.

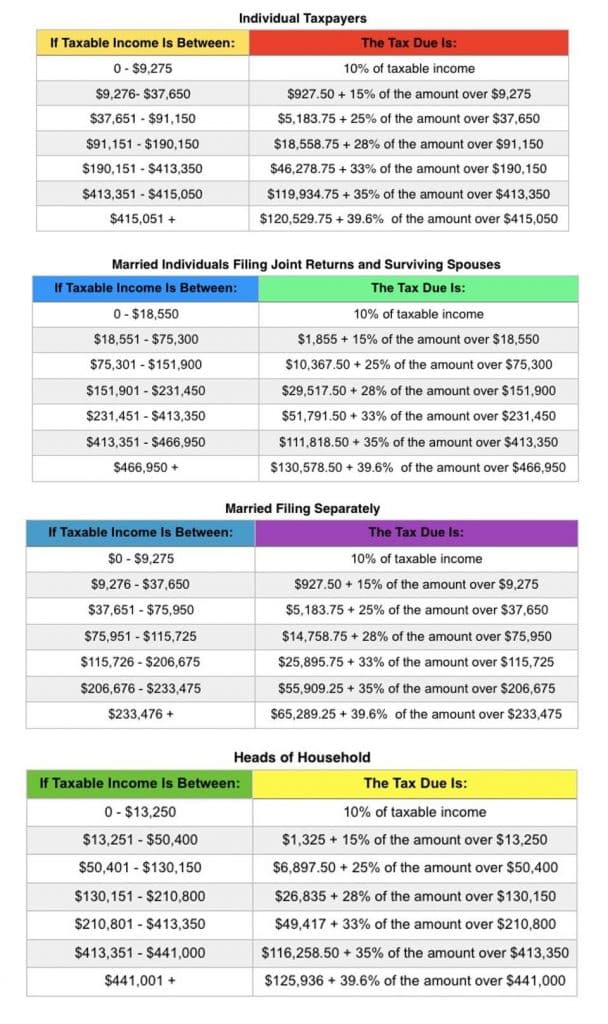

Tax Brackets for 2016-17

These brackets have been in effect as of January 1, 2016. These values are needed to prepare your taxes for the tax returns you’ll get in 2017. You can use the following table to calculate your liability for the 2016 tax year.

Tax Brackets for 2016-17

These brackets have been in effect as of January 1, 2016. These values are needed to prepare your taxes for the tax returns you’ll get in 2017. You can use the following table to calculate your liability for the 2016 tax year.

Consulting the above table, you can make an estimate on how much you have to pay for your taxes. You might be expecting to make more money, or get married, and in these cases you have to tweak your estimates and adjust your withholding accordingly.

IRS subjecting LLC member income to self-employment tax

IRC Section 1401 states that “self-employment income” is taxed at 15.3%– 12.4% and goes to the Old-Age, Survivors, and Disability Insurance tax, with the remaining 2.9% earmarked for the Hospital Insurance tax.

An extra 0.9% tax is added on to a taxpayer’s self-employment income in excess of $250,000 if married and filing jointly, and $200,000 if single. Thus, the total self-employment tax burden as of the latest regulations can reach as high as 16.2%, before considering the deduction for one-half of the self-employment tax (not including the new 0.9% surtax) as permitted by IRC Section 164(f).

Forbes has compiled a detailed review on the changes imposed on LLC member income taxes in their magazine (October issue). You can get detailed information on the adjusted inflation rates for other sectors like medical, itemized deductions, and lifetime learning credits on the IRS news forum.

For more information on this topic, or to learn how Smith & Smith CPA’s tax specialists can help, contact our team.

Source: www.irs.gov, www.forbes.com

Image Source: www.forbes.com