What Is The Need For Tax Planning?

What Is The Need For Tax Planning?

Taxes are an unavoidable part of our lives and all of us must pay them. However, it is not important for you to pay more than you need to. Most people do not plan their expenditures well and their taxes end up costing them more. Tweaking your financial planning can help you to save some money when it comes to paying taxes. Paying fewer taxes is as simple as considering a large purchase and understanding if paying for it later would make some difference to your tax bills.

What Is Tax Planning?

Tax planning is a method that employs effective strategies to reduce your tax liabilities. It goes hand in hand with your overall financial planning and helps you to achieve your financial goals. It gets difficult to achieve your short-term or long-term goals without planning your taxes for your present situation. Hence, the main purpose of planning your taxes is to reduce your tax liabilities and secure a solid future.

What Is The Need For Tax Planning?

Now that we have discussed what tax planning essential is, let us move on to why it is advisable to plan your taxes. It can help you to save some money and secure your future plans effectively.

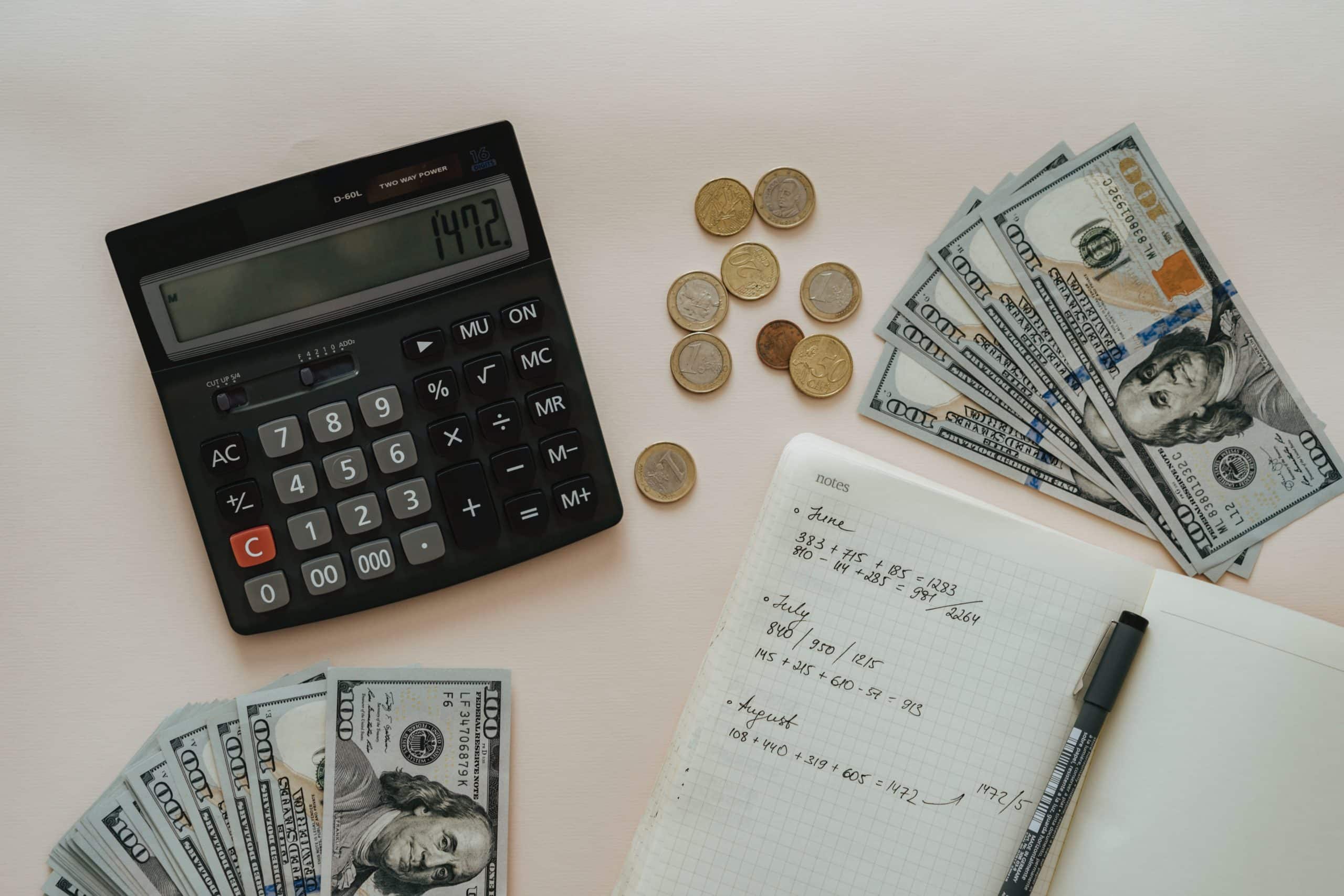

Can Help You To Pay Lower Taxes

The endgame of tax planning is to reduce the amount of money and your tax liabilities. The importance of tax planning lies in situations such as:

- Planning your tax is important if your own a business or even if you are self-employed

- If your investments have suffered recent hefty losses or gains

- When there is a major change in your life, such as getting married or divorced, having a baby, retiring, or buying a new house.

- When your income is going through some serious change

- When you are sending your children to college for higher education.

Gives You Time To Strategize

Some people often wait for the last moment to use a tax benefit. Though this might work for some, effective planning entails year-long planning and not just the last day before your taxes are due. You must invest enough time to study the financial situation and make appropriate choices.

Avoid The Dread Of The Deadline

The government could make several changes to the tax laws, but the deadline does not change. You have a firm deadline to decide how you want to deal with these changes. Tax planning well before time ensures that you are ready to deal with any kind of change and you won’t even have to worry about the deadline dread. What are you waiting for? Visit your tax planning consultant today and avoid the deadline dread.

Reap Maximum Benefits From The Changes Made By IRS

Tax laws are ever-changing. Planning your taxes well ahead of time will help you to deal with these changes. No matter how minor or major the change is, tax planning will ascertain that it does not affect you adversely.

We hope this blog has provided you with the required information. Looking for the best tax planning consultants in Arlington, TX? Visit us at Smith & Smith CPAs and get the answer to all your queries.