Apply For Tax Relief Using Charitable Donations

Apply For Tax Relief Using Charitable Donations

The IRS makes it complex when it comes to imposing taxes on assets. This is because they focus to help the taxpaying citizen save as much as possible by selectively assigning tax relief to certain assets. One of the best ways to ensure that you qualify for deductions is to itemize your assets when you list them to pay your taxes.

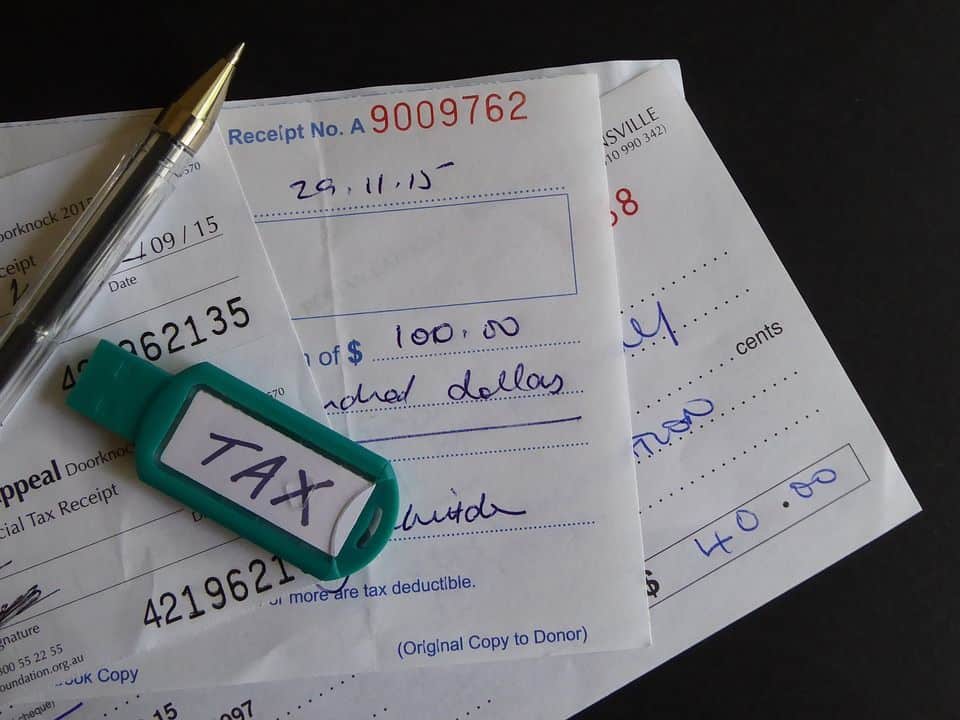

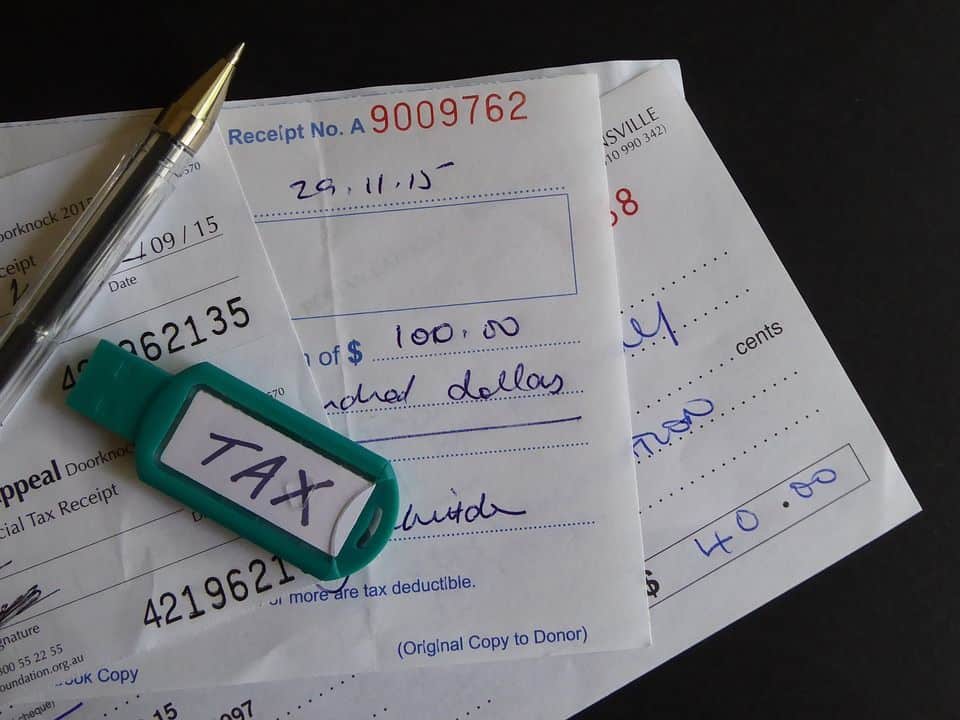

Charitable donations are another way to make sure that the part of your income that went to charity is exempt from taxation. However, this only works when you pay through the right agencies. You need solid advisory services to help you set up the right channels to make this happen and apply for tax relief.

How are charitable donations exempt from taxation?

There are certain rules exercised by the IRS that allow charitable donations to specific, authorized organizations. The best course of action is to itemize your assets before donating a portion to acknowledge which ones are already qualified for tax relief, assuming you expect the same from your donations.

The IRS reserves a set of conditions that allows tax relief.

- Donations to a state, or United States possession, including District of Columbia, which are made for public purposes exclusively, are qualified for deductions.

- The community chest, corporation, trust, or foundations that have been organized in the United States can accept donations that will be eligible for tax relief. However, these entities have to be operated for charitable, religious, educational, scientific or literary purposes, and prevention of cruelty to children and animals.

- Tax relief is available for charitable donations to war veterans’ organization or its auxiliary, trust, or foundations that have been organized in the United States or its possessions.

- Donations to certain volunteer organizations such as a non-profit volunteer fire company are also eligible for deductions.

- Tax deductions can also be made on donations to civil defense organizations under state, federal, or local law. It also includes unreimbursed expenses of civil defense volunteers that are directly connected to the service.

- Non-profit cemetery companies can also accept donations that are qualified for tax relief provided the funds are used in caring for the cemetery, mausoleum, or crypt.

Saving on taxes

As a general rule, donations qualify for tax deductions up to 50 percent. There are several other factors that influence these deductions will vary accordingly. Your charitable donations are qualified for relief only if paid in cash or cheque. You can consult advisory services to ascertain your best course of action.