Guide to Filing Taxes in for the 2016 -17 Season

Guide to Filing Taxes in for the 2016 -17 Season

Now that we are edging closer to 2017, it is imperative that you consider tax planning for your business at this early date. There are a few changes from last year that you have to consider during your tax preparation. Let us explore these changes in detail.

Tax Filing Deadline

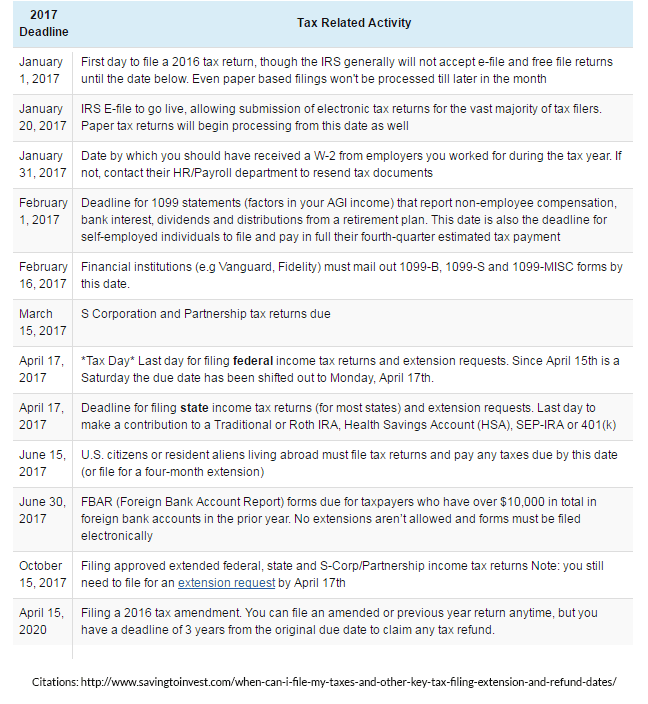

For the season 2016 – 17, the deadline for paying out your taxes is scheduled for midnight, April 17th, 2017. You need to have completed all your filing by this date in order to avoid being penalized. If you want to request an individual return tax filing extension, or the 2016 IRA contributions, the deadline remains the same.

There are additional changes pertaining to cost basis reporting, exemptions and savings for the medical sector, homebuyer credits, and health insurance deductions. You need to be aware of these changes when preparing for tax filing or have a CPA review your preparation.

You can get the 1099-B, 1099-S and 1099-MISC forms here.

You can file for your extension request by following this link.

Cost Basis Reports for Individual Investments

Your cost basis of your investments is no longer reported by the taxpayer, but by the brokers and custodians in charge of your assets. They will report to the IRS directly and this is a change that was invoked as of 2011. This method was initially intended to ensure that all reports on tax forms were authentic. These requirements were introduced by the Emergency Economic Stabilization Act of 2008.

United States Department of the Treasury

This minor change has significantly simplified tax preparation for investors. The effects, however, came into play in phases. Custodians started reporting on covered and non-covered securities, mutual funds, exchange traded funds, and dividend investment plans. This was back in 2012, and it was only a year later that they included reports on fixed income options and other securities.

The previous setup had the custodians report only on the sale and the taxpayers had to go back a few years to find out how much they paid for it. This method was not viable and created a lot of hassle on the taxpayer’s part.

Positive Changes to help Tax preparation for 2017

While the IRS imposed several clauses to change the way taxes were filed, they have made organization of your assets easier. Even with little amendments made each year, the filing system becomes easier for the taxpayer. As of this year, you can expect these changes to help with your planning.

- Decrease in standard mileage rates: If you have been using a vehicle for strictly business, the rate is 54 cents per mile as of 2016. This applies to a car, van, or panel truck. If you have been using the vehicle for a medical reason, or for a move that is tax deductible, the rate is 19 cents per mile. For service provision to charitable organization, the rate is the same at 14 cents.

- Homebuyer credits: Being a homebuyer who claimed the first time credit for property bought in 2008, you stand to make about one seventh of the 15 annual repayments on the return in 2016. You can find additional information about your homebuyer credits and how much you stand to make on your return on line 67 of Form 1040.

- Exemptions made on medical: The IRS has a limit on personal exemptions that you can make on your medical expenses. The limit has increased to $4050 as of 2016. If you haven’t used your Health Savings Account (HSA) for eligible medical expenses, the additional tax has been increased to 20%. If the medicine is a prescribed drug or insulin, then the payments for the medicine will be considered qualified medical expense.

Health Insurance deductions, Capital gains and losses

Self employed individuals who are eligible as per IRS criteria can take a self employed health insurance deduction. This option is available from 2016. This deduction is also applicable for spouses and other dependents, as well as non dependents provided they are under the age of 27.

Reporting capital gains and losses used to be carried out by Schedule D. This is now used as a summary and the report is officially filed in a separate Form 8949. The form will have a detail on all your capital gains and loss transactions. The older form is now used for reporting total sales price, adjustments for individual transactions, and figuring the tax.

Preparing for your tax payouts is the most important part of your tax payment responsibility. If you have a CPA handling your accounting, then it is best to have the tax preparation done professionally. Make sure that you don’t miss the deadline or you will have to fork over unnecessarily large amounts as penalties. Remember to stay updated on the latest changes in tax laws to avoid being audited by the IRS.

If you are running a business or individual, Need an expert help just dial (817) 466-9333 or (972) 287-5593