Filing as LLC Partnership is Better than S Corp

Filing as LLC Partnership is Better than S Corp

The business structure is the first step if you’re starting a new enterprise. Before you can chalk out the rest of your business bucket list, you need to understand if the structure is based on LLC or S corp. You need to understand the differences in the two systems when filing your tax returns for your business. For example, a Limited Liability Company allows opportunities for unlimited partnership across multiple countries but with S corporations, it is limited to a 100 members at a maximum.

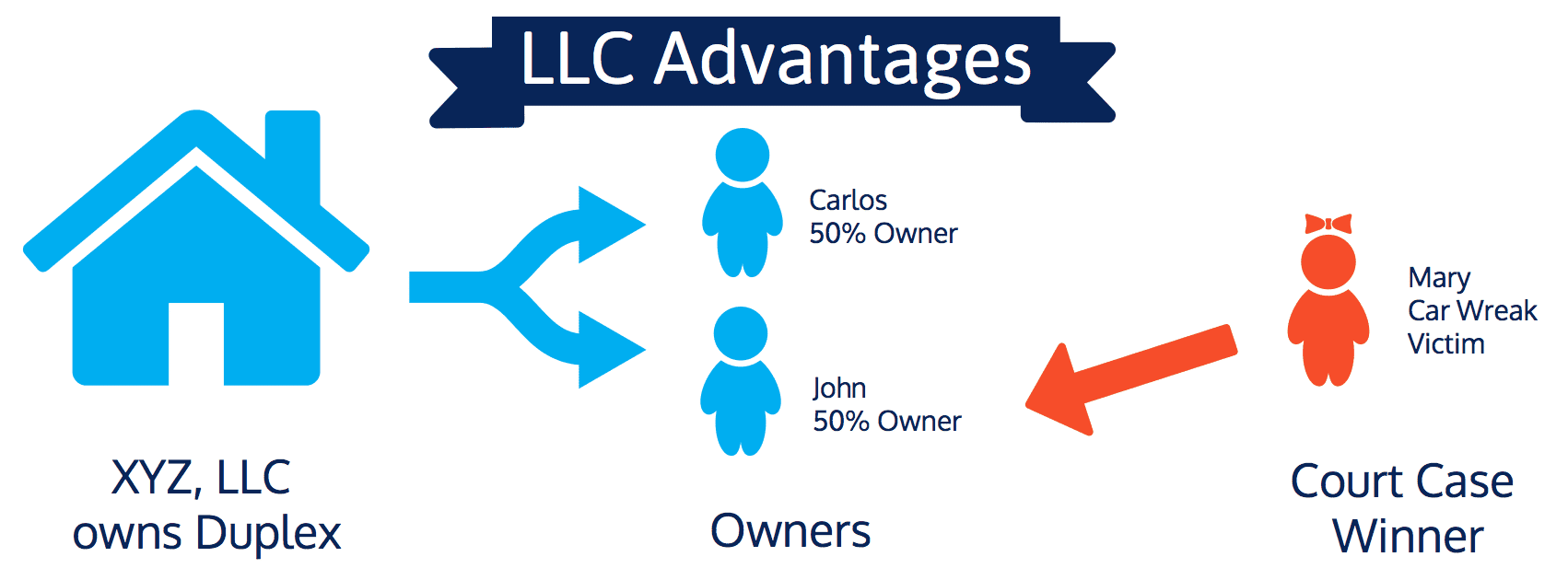

Advantages of LLC

A limited liability company means that the company can have an unlimited number of partners all over the world receiving a share of the company profits directly. It does not depend on the amount of work that is being done by the individual members unlike an S corporation, which means your tax returns will be calculated on a whole. It also means that the profit divisions are not restricted by the amount of shares in the company.

In an LLC, informational tax returns do not need to be filed as it is directly obtained from the owner’s tax filings. This simplifies the process unlike an S corporation which requires separate filings for all members in the system. Because of this, they have to hold an annual shareholder’s meeting to assess the financial situation and file the statements with the state in which the company is based.

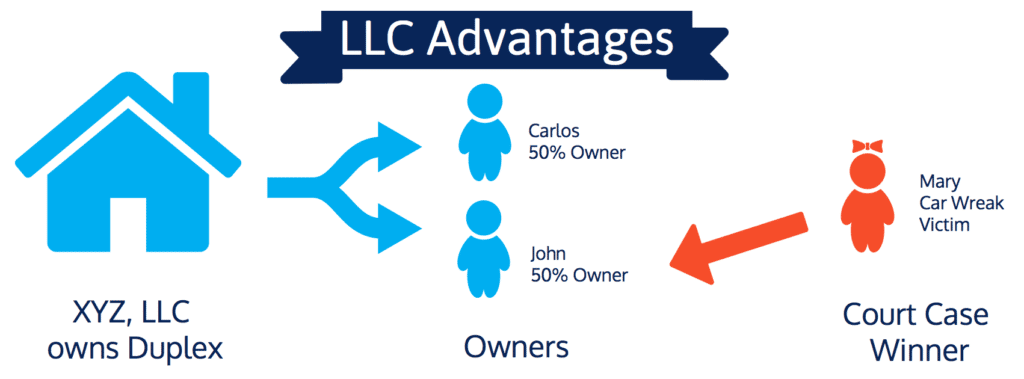

Profit distribution in partnership

An LLC is dependent on the owner’s decision. In this business strategy, your contribution to the investment is irrelevant. You are in charge of deciding and coming to an agreement with your partners regarding how the profits from the company will be divided. For example, if your investment is in 25% of the company you run with a partner, you can still divide profits in half if you are doing all the work and your partner agrees on the division.

This makes it a mutually beneficial business strategy that also provides easy tax returns unlike an S corp. The profit distribution in an S corporation is limited to the amount of investment made by the partner. For example, if you have invested in 25% of the company, your profit will be 25% of the whole irrespective of the amount of work you do.

Considerations when paying Federal Taxes

There is a significant advantage with an LLC when it comes to considerations on Federal Taxes. An S corporation also qualifies for the same, but is more complex owing to its investment-profit dependency. An LLC calculates the tax returns on the whole, which allows considerations on the additional federal taxes. While the partnership is created under state laws, S corporations are more partial to the federal tax system. This makes both entities eligible for federal tax considerations with the only difference existing in the complexity of the payouts.