2018 Tax Rate, Brackets, Standard Deduction Amount and Extras

2018 Tax Rate, Brackets, Standard Deduction Amount and Extras

The consumer price index (CPI) has ticked off from 2.2% to 0.4% for this August as prescribed by the U.S Bureau of Labor Statistics. CPI takes into account of your cost of living. When CPI is not flexible enough, it tends to signal that interest rates will stabilize. This is the most valuable information for all the taxpayers as Tax Code will afford for mandatory yearly modification to certain tax items based on rising in price.

Federal income tax bracket seeks all attention for nearly 30 years. But this rise in tax has become confusing for most of the taxpayers as inflation adjustment are routinely included in tax legislation.

But there are tax professionals who can sort things for you, like Bloomberg BNA.

Bloomberg BNA predicts tax savings for many in 2018

In 2018 Bloomberg BNA estimates the increase in the annual gift tax exclusion in 5 years from $14,000 to $15,000.

The report includes:

- Probable retirement planning figures that cover up

- conventional IRA and ROTH IRA input limits

- qualified retirement contribution deduction constraint

“As part of their 2017 year-end review, taxpayers should evaluate their wealth transfer strategies to fully utilize the higher exclusion in 2018. Many taxpayers will slip into a lower tax rate in 2018 because of increases in the tax brackets. The standard deduction and personal exemption amounts will also increase, offering tax relief to many taxpayers due to inflation.”

- personal discharge

- enumerate deduction phase-out for high-income taxpayers

- AMT threshold

- the yearly gift tax exclusion

- business expensing confines

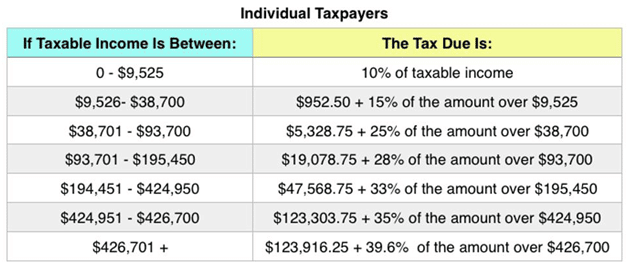

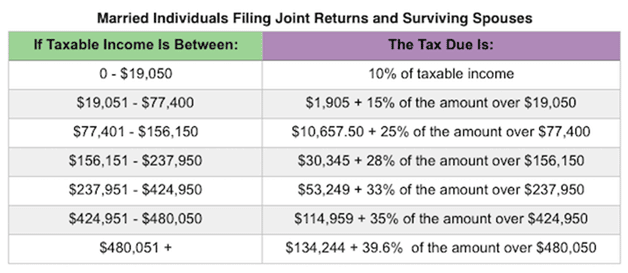

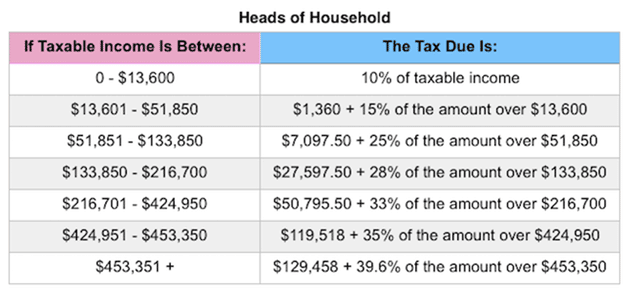

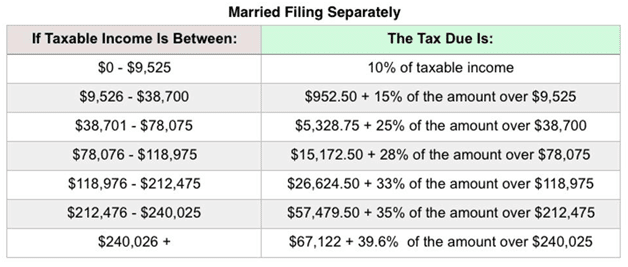

Tax bracket

Higher CPI pushes the rate of the tax higher and has increased the standard deduction and release amounts, but the tax that will remain due on the same income will tend to decrease.

In 2017, 33% brackets were paid in $53,427 in tax. BNA forecast in 2018, that the same taxpayer is now in 28% bracket and will pay $52,983 in tax, saving near about

Personal Exemption

The personal amount is fabricated as a slight increase to $4,150 from $4,040 in 2017.

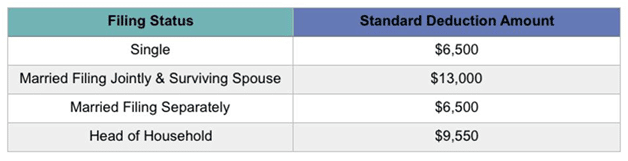

Standard Deduction

In 2018 the sum total of the standard deduction is estimated to frame up slightly. Concerning 2/3 of all taxpayers resolves all file, using the standard deduction: whereas taxpayers who have additional itemized deductions than the standard deduction will file a Schedule A.

The projected standard deduction amounts for 2018:

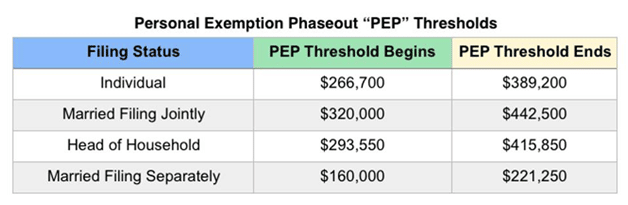

High-income taxpayers who itemize their deductions, the Pease limitations, named after former Rep. Don Pease (D-OH) may phase positive deductions.

The Pease thresholds for 2018 are anticipated to be:

Retirement Savings Account

Bloomberg BNA projects the utmost payment limit for traditional and Roth IRAs will continue at $5,500 for individuals under age 50 with coming up to contribution totals investment steady at $6,500 for individuals age 50 and above.

Federal Estate Tax Segregation

The federal estate tax segregation for decedents becoming extinct in 2017 was $5.49 million each or $10.98 million per married couple.

BNA projects this amount will frame up to $5.6 million per person in 2018.

Tax Exemption From Gift

Bloomberg envisages that the annual exclusion for federal gift tax purpose will increase to $15,000 in 2018.

Check the details in the PDF here.