Payroll and Tax Deductions

Payroll and Tax Deductions

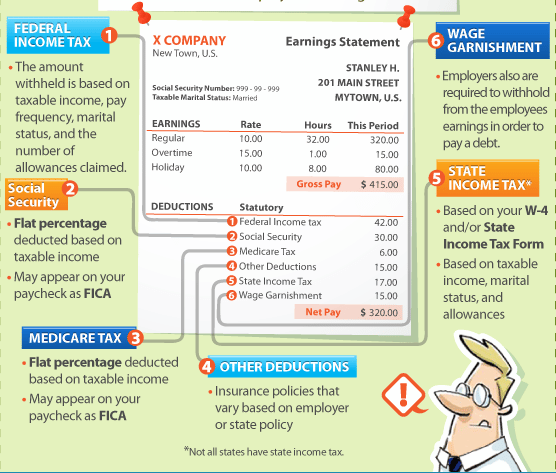

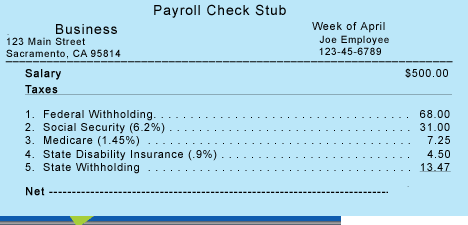

Most employees are not aware of all the deductions from their wages.It’s important for everyone to understand what is being taken out of their paycheck and why.

What Gets Taken Out of Your Paycheck

There are 6 common payroll deductions made from an employee’s earnings.

Federal Tax Brackets

These percentage reflects how much of your paycheck will be deducted for federal income tax and the reminder may be distributed among the sections listed below.

[wptg_comparison_table id=”1″]Social Security

Contribution rates for these benefits

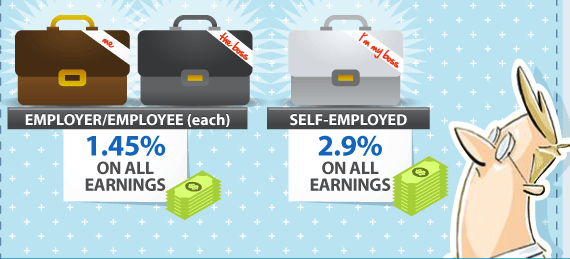

Medicare Taxes

Rates vary depending on your role

Other Deductions

Disability deductions are meant to recognize the expenses for care of a disable person, allowing them or a family member to work.

Types of disability deductions

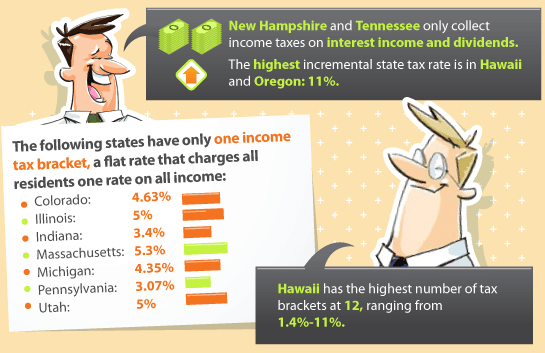

Special State Tax Situations : Exceptions to the Norm

There are 9 states that do not collect income taxes.

- Alaska

- Texas

- Florida

- Washington

- Nevada

- Wyoming

- South Dakota

- Tennessee

- New Hampshire

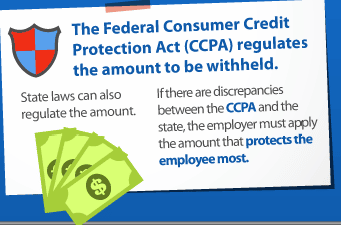

Wage Garnishment and Assignments

Wage Garnishments

For assistance on collecting debts, creditor go to the courts.

If the court grants the creditor’s request, a summons will be issued, and the employer will be instructed to withhold a certain certain amount from the employee’s paycheck in order to pay off the employee’s debt.

When the employer’s receives the summons, it is required to determine how much of the wages are subject to the garnishment order. It will then issue a check for that amount.

If multiple garnishments are requested for the same employee, those that involve child or spousal support, tax levies or student loans may take priority over the first garnishment order.

Wage Assignments

A wage assignment is a voluntary assignment between the employee and creditor to assign a portion of the employee’s wages to pay off a debt.

Court-ordered garnishments can be avoided because wage assignments are usually signed when the when the debt is incurred.

The amount deducted is not regulated by the CCPA, unless it is unpaid and leads to a court-ordered garnishments.

Wage assignments are regulated in some states.

Others just apply the state’s law of contracts, while other states completely prohibits them.

Smith & Smith CPA’s can help employees and businesses for the payroll and tax deductions, Call (817) 466-9333 or (972) 287-5593

References:

https://www.retirementliving.com/taxes-by-state

http://www.money-zine.com/financial-planning/tax-shelter/

https://www.ssa.gov/pubs/EN-05-10003.pdf

Image Source: www.taxes.ca.gov