How Much Tax Could You Save With Real Estate?

How Much Tax Could You Save With Real Estate?

You have the option to invest in real estate in order to save more on taxes. You can recover the cost of income-producing property through depreciation, using 1031 exchanges to defer profits from real estate investments, and also borrow against real estate equity for other investments.

If you are a homeowner, you can benefit from the personal-residence exemption. This protects your profits on the sale of a personal residence from capital gains taxes including deductions for mortgage interest.

Depreciation

You can recover the cost of a rental property through annual tax deductions called depreciation if you generate an income off it. There are several ways to depreciate your property.

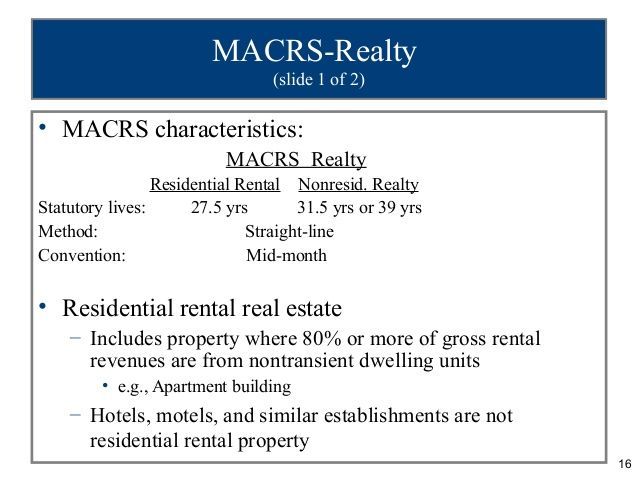

The MACRS method is the most popular when it comes to real estate investors.

Depreciation expense often results in a net loss on investment property even if the property actually produces a positive cash flow. These losses are reported on Schedule E, federal income tax form 1040, and deducted from ordinary income.

This method can last for years considering how long you want to have your property depreciated. The general limit as per the MACRS method, you can depreciate over a period of 27.5 years on your property.

1031 Exchanges

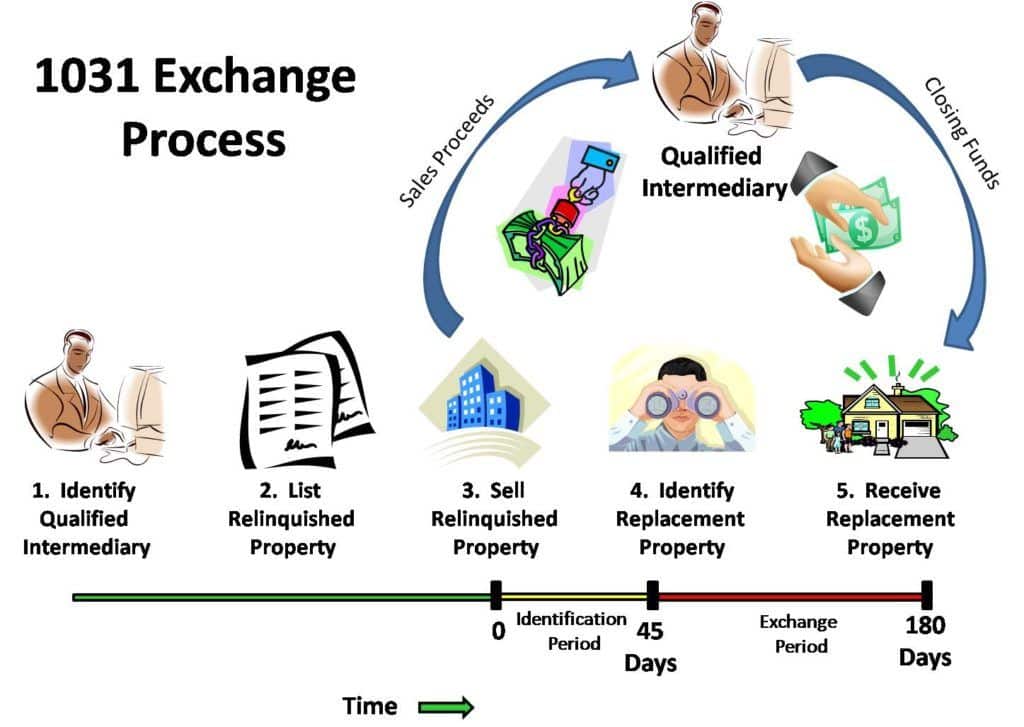

The 1031 exchange happens when an investor decides to sell an investment property and invest the proceeds in another property.

- In a tax-efficient method, the investor enters into a 1031 exchange agreement with an intermediary and puts the original property up for sale. At the same time, the investor begins the search for other properties.

- On the day the investor sells the relinquished property, the total proceeds after paying all expenses are sent to a specific account set up by the qualified intermediary.

- The identification period which follows has exactly 45 days. The investor must draw up the list of potential properties within this time and will have an additional 180 days to close the purchase on the new property.

- The qualified intermediary wires those funds to the title company, the special account is closed and the transaction is completed.

Making the most out of your investment properties

If you have a large equity in your investment property, you can refinance and pull out equity to make other investments, or improve the home. There are different regulations regarding the matter in each state. In the real estate world, this is coined as borrowing against equity.

You can use this method efficiently to invest in multiple properties. You can also deduct the portion of your mortgages that can be attributed to interest payments on your tax returns. These payments gradually decrease as the mortgage gets paid off.

Your current financial situation will help you decide on which option works best for you. However, as is evident from the different methods available, you stand to save a lot more on your taxes if your income is generated mostly from real estate.

Source: www.investopedia.com , www.irs.gov, homeguides.sfgate.com

Photo Source: www.mattpage.net , www.irs.gov, www.illinoisreview.typepad.com