8 Policies to Consider a Better Political Standing for Your Business

8 Policies to Consider a Better Political Standing for Your Business

A Fair Tax System for Businesses

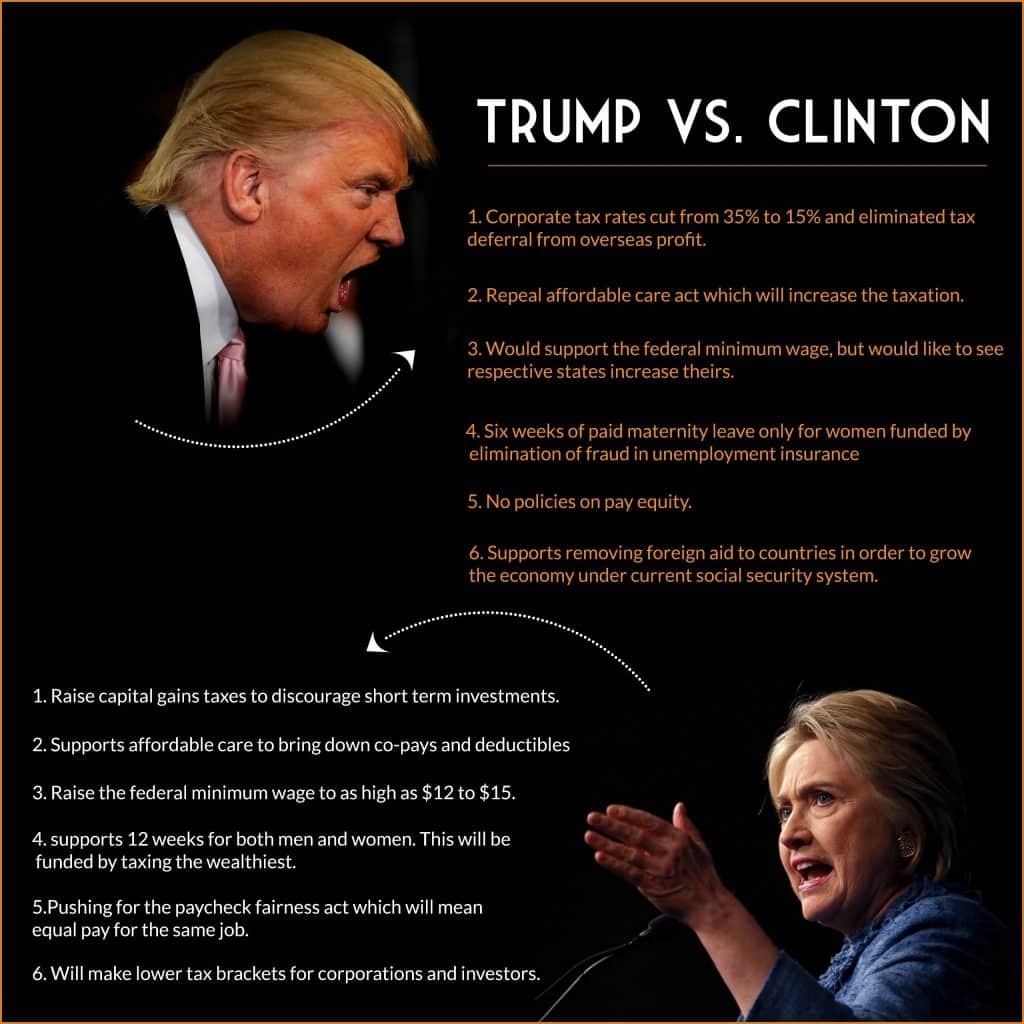

With the recent presidential election, you can expect a few major changes to affect your business for better or for worse. So which candidate will be a better bet for your business?

You have to consider each of their policies that they have proposed for the office. While Donald Trump has vowed to bring about a non-immigrant policy that is focused on lowering taxes on local businesses, this would prove to be a blow for multinational corporations that brings in the big dollars on Wall Street. You can expect a rapid fall in stocks, and the bond market will capsize while the national debt gets renegotiated.

These policies will be greatly beneficial for the business sector. Let’s find out how things will differ from the Republican Party proposals. The following infographic explains the major points of difference in proposals between the two presidential candidates.

According to Hillary Clinton

“It’s outrageous that multi-millionaires and billionaires are allowed to play by a different set of rules than hardworking families, especially when it comes to paying their fair share of taxes.”

According to Hillary Clinton’s website – these are a few points regarding her policy that can benefit businesses.

- Raise capital gains for a business will discourage short term investments. This means the business will have more long term investors and will make financial management easier. This is harder for startups as people will be more conscious about long term investments.

- Impose restrictions and increase taxes on companies with foreign operations will help give a boost to the local economy. However, multinational companies will have to rethink their finances on account of the added taxation.

- Add a risk fee on large banks which will make getting loans easier for both large and small businesses. This also protects the banks from bad investments. This also holds true for other financial institutions.

- Supports a raise in Federal minimum wage. This is one of the better policies for the employees. While the businesses and corporate offices will need to reinvent their capital and financial strategy, this will mean more employees who are satisfied with their remuneration.

- Proposed longer paid maternity leave (up to 12 weeks) funded by taxation on the wealthiest is one of the policies that are very popular with democratic ideals.

- Supports Overtime Rule to help employees in getting paid for overtime. This would make longer hours and overtime work worth it for the employees ensuring a greater job satisfaction.

- Expand affordable care act to reduce co-pays, and reduce cost of prescription drugs will help businesses implement better medical aid for their employees.

- Better retirement plans as proposed by the Democratic Party will be implemented through increased payroll cap, improved benefits for caregivers and low income seniors, and implementation of the fiduciary rule.

Democratic nominee Hillary Clinton, who is the opposition, has been discussing major reform policies that will be better for business, both local and multinational. However, she stands to impose taxes that will amount to as high as $1 trillion which can cripple the economy – not to mention, we might see the dawn of world war III under her foreign policy.

Source: www.hillaryclinton.com, www.donaldjtrump.com

Photo Source: woodall.house.gov