7 Bad Habits Tarnishing Your Effective Bookkeeping Practices

7 Bad Habits Tarnishing Your Effective Bookkeeping Practices

Explore those. Take a Note…

Business without effective bookkeeping is like flying in the air without strong wings.

There had been a time when the wise used to say – “Slow and Steady wins the race”, well now the time has changed, its 2016, and thus one must indeed adhere to – “Smart & Innovative wins the race”.

Now, possible you might be pondering over what are the 7 bad habits that could or already ruined your business progress.

Stay relaxed, release your feelings, and explore these bad bookkeeping habits given below. After all, realization is liberation from misery, and eventual rectification is the door to treasury.

- Unmanaged Due Dates & Deadlines

Bookkeeping would definitely develop flaws if you do have the habit of not setting proper deadlines and due dates for your financial reports.

This habit could often make you ask yourself – “Where have I kept my account details?” or more embarrassingly – “Due dates are near, Oh my God! Where have I kept my files?”

- Poorly Maintained Payroll Taxation

If now you are not worrying about your unmaintained Payroll Taxation, you would surely do when the IRS authorities would come to your house and make you say – “All hell have gone loose!”

- Neglecting Periodic Accounting

If you are not keeping up periodic accounting then you are likely to stay behind your competitors and watch them shine like a star.

Leveraging an advanced bookkeeping software can certainly help in keeping your bookkeeping smart, fast, and effective.

Periodic Accounting is very much important to manage financial affair of business and the task gets way to easy when an effective accounting software is leveraged.

Moreover, many of the prominent accounting softwares could compute and yield the result of complex data with clear visuals and accounts report.

- Hiring a Fresher to Manage Complex Bookkeeping

Hiring a newbie accountant could help in saving a few bucks than hiring an experienced stallion, however, he or she could also bring over many sleepless nights by making sensitive mistakes on creating an accounts based report and triggering the IRS authorities to summon you.

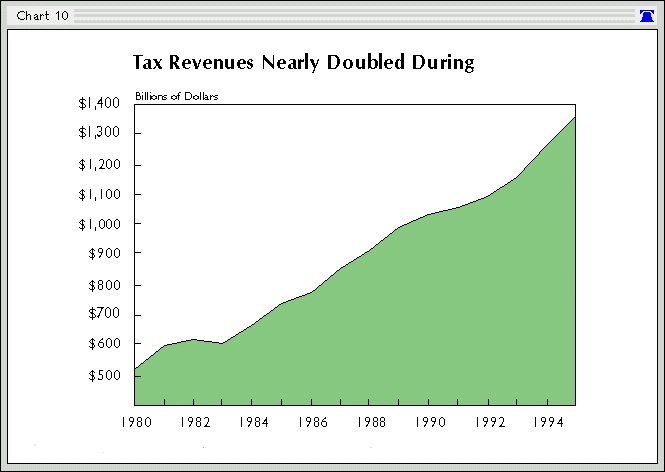

- Not Keeping Track of Revenue Reports

If you are getting paid from a source but failed to keep a track over the invoices and documents showing whether you got paid, this could entangle you in number of problems as the relevant documents corresponding to cash flow would appear to be void.

- Stuffed and Unorganized Filing Cabinet

If your Filing Cabinet is overflowing with stacks of accounts data and invoice reports, you are more likely to miss certain deadlines of report submission, and this is certainly because of unorganised bookkeeping system.

- Not Staying Updated with Technology

If you think “Old is Gold” and prefer sticking to manual way of managing financial affairs, then that is certainly unintelligent as your competitors would leverage powerful modern accounting softwares to empower their bookkeeping system and leave you in dark.

Managing financing affairs, or in layman words bookkeeping, is certainly an inextricable part of business that requires special attention and smart minds who can leverage innovation and digital intelligence in order to establish something strikingly extraordinary.

For more information about Bookkeeping Practices you can contact – Smith & Smith CPAs